Tornado Cash, Celsius and 3AC updates. Australia plans crypto rulebook. DTCC settles equity tx on private blockchain. DeFi loan to tradfi.FDIC accuses FTX US of misleading statements.NFT lending pain.

CryptoLaw Newsletter #63

Hello everyone,

TLDR:

Tornado Cash: US Rep question to Treasury; hackers turn to alternative, non-sanctioned crypto mixers

Australian government wants world’s first token mapping excercise, preparing for crypto rulebook

DeFi x tradfi: MakerDAO formally opens $100 million DAI loan to traditional bank

US FDIC accused FTX US and others of misleading statements on FDIC deposit insurance

US DTCC launched a private, permissioned blockchain for securities settlement, processing over 100,000 equity transactions a day

Up next week: our podcast on the Travel Rule and KYC/AML in crypto with Catarina Veloso, legal engineer at Notabene. Stay tuned!

Top-5 this week:

Tornado Cash sanctions. US Rep Tom Emmer sent a letter to Treasury Secretary Janet Yellen on the Tornado Cash sanctions. Relying on FinCEN’s distinction between a crypto mixer (a person who accepts and transmits anonymized funds on behalf of customers) and an anonymizing software provider (a person who merely provides software that may be used by mixers or others), the letter concluded Tornado Cash is the latter, not the former. *** Developer Alexey Pertsev will remain in custody for at least another 90 days, a Dutch court ruled. Pertsev was arrested in the Netherlands for allegedly facilitating money laundering via the Tornado Cash app, soon after US sanctions on the crypto mixer and related wallets.*** Meanwhile, hackers behind the infamous Ronin bridge attack, believed to be North Korean-sponsored, started using a different crypto mixer to launder their stolen funds – one that has not yet been sanctioned by US authorities. *** In the wake of the Tornado Cash sanctions, Flashbot developers are accelerating the open-source release of its MEV-Boost code. The team had face a backlash after announcing it would censor Tornado-linked transactions in a default setting.

The Australian government announced its crypto plans: it wants to undertake what it claims to be the world’s first ‘token mapping’ exercise. It plans to address gaps in the existing crypto regulatory framework, progress work on a licensing framework, review innovative organisational structures (DAOs?), look at custody obligations for third party custodians of crypto assets and provide additional consumer safeguards. A consultation paper on token mapping will be released soon.

DeFi x tradfi: MakerDAO formally opens $100 million DAI loan to a traditional bank, Huntingdon Valley Bank.

The US FDIC accused FTX US and other crypto companies of making misleading statements about FDIC deposit insurance.

The US Depository Trust and Clearing Corporation (DTCC) launched a private, permissioned blockchain for securities settlement. Project Ion is processing over 100,000 equity transactions per day on DLT.

And also…

South Korean regulators flagged 16 foreign crypto exchanges including KuCoin and Poloniex and plans to block domestic access to foreign exchanges that lack the proper registration to operate.

A Signapore court allows the liquidators of 3AC to probe the crypto hedge fund’s remaining assets there.

Europe crypto lobby group BC4EU and Digital Euro Association ask for clarifications on non-euro stablecoin rules in draft Markets in Crypto Assets Regulation. “The three largest stablecoins by trade volume are at risk of being banned in the EU from 2024, due to quantitative limits on issuance and use of EMTs denominated in foreign currency under MiCA,” it wrote

Celsius. Crypto lender Celsius continues to ruffle feathers. It countersued KeyFi, which had previously accused it of failing to honor a profit-sharing agreement. According to Celsius, KeyFi and its CEO of siphoned off funds and covered their tracks through crypto mixer Tornado Cash. *** Celsius also sued Prime Trust, a former crypto custody partner that it alleges still holds $17 million of Celsius‘ crypto. *** Last week, Canada’s second-largest pension fund manager has written off its $150mn investment in Celsius and conceded it went into crypto “too soon”.

Over 9,000 mining rigs were seized in Iran the past year.

Can my client use bitcoin to purchase property? The Law Society in England & Wales offers advice. The scenario? “I’m the money laundering reporting officer of a specialist conveyancing firm instructed to act in the cash purchase of a local property for £795,000. Customer due diligence checks uncovered that the money is from the client’s investment in bitcoin. Does the Law Society have guidance on bitcoin?” The advice covers a number of standard steps, adding one may “consider that a significant risk in this transaction is that the bitcoin may be derived from criminal activity.” What if you think you don’t have the necessary skills or time to do an AML check? In that case, “consider whether you should decline to act”.

Ontario’s securities regulator warns against Kucoin and other non-registered crypto entities.

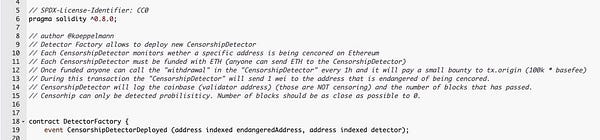

Want to check if an Ethereum address is censored by certain miners/validators?

A Russian citizen was extradited from the Netherlands to the US to face charges of laundering crypto ransomware.

YouTuber BitBoy sues another YouTuber for defamation in his video ‘This Youtuber Scams His Fans’.

DAO land.

NFT lending protocol BendDAO adopted emergency measures amid a flurry of liquidations. “The bear market shows no mercy to products developed with ‘up only’ mechanics,” TheDefiant commented.

Uniswap governance tokenholders voted in favour of establishing the Uniswap Foundation, which will support governance and open source development within the Uniswap community.

Fei protocol is shutting down, citing mounting technical, financial, and future regulatory risks. The way in which it plans to wind down caused uproar, including from early supporters. Critics argue the protocol should use its treasury to reimburse victims of a $80 million hack. Instead, they believe the Fei team’s shutdown proposal allows the team to keep the remaining funds for themselves.

Beijing envisages the metaverse as part of the city’s development plans. Virtual reality may become part of the city’s tourism and cultural outreach.

A UK High Court grants restraining order over NFTs, confirming they are “property” under English law. Law firm Eversheds Sutherland summarizes the highlights: according to the Court, “there is a realistically arguable case that NFTs are property for the purposes of English law, (ii) on the basis of [claimant]’s domicile in England, the NFT’s were also to be treated as located in England and (iii) damages were not an adequate remedy for [claimant] due, in part, to the unique, particular and personal value the NFTs had to her”.

Law firm Baker McKenzie reviews US Patent Office decisions related to the metaverse, NFTs and digital goods. Two key takeaways: (1) you can‘t claim a trademark for a broad term like ‘NFTs’, which is “indefinite”, according to the USPTO. You’ll need to clarify which type of NFT you want to obtain a trademark for. (2) A trademark for physical goods likely also covers its digital twin: ‘digital trading cards’ are related to ‘physical trading cards’, according to the USPTO and virtual baby boy clothing is related to physical baby boy clothing.

The US SEC treats crypto like the rest of capital markets, wrote Chair Gensler in a WSJ op-ed.

Crypto exchange Coinbase turned to the US Supreme Court with a motion to stay legal proceedings brought by a user claiming to have lost funds through Coinbase’s poor security measures. The Supreme Court refused. A California judge had previously held that Coinbase's arbitration restrictions are unenforceable under California contract law, allowing the matter to go to trial, writes Around the Blockchain.

Law firm Wachtell Lipton discusses regulating crypto with existing tools on Columbia’s Blue Sky Blog: (i) clarify the rights of customers relying on an intermediary to hold their cryptoassets, (ii) confront the reality of what the classification of cryptoassets as securities means and (iii) recognize the existing authority for stablecoins to be issued by banks as representative of actual deposits or to be issued by registered money market funds.

Around the Blockchain’s latest newsletter covers Polygon's new Chief of Legal; SEC v. Dragonchain; OFAC's power; Coinbase's Motion to Stay; The road ahead for Celsius, and much more.

Thanks for reading!