OECD crypto tax reporting guidance, US SEC looking into Yuga Labs, Portugal reconsidering crypto tax, NFT royalties on the chopping board, FSB consults on crypto framework

CryptoLaw #65

Hello everyone,

After a long break, we’re back due to popular demand. Here’s what’s been happening in crypto & law - lots of EU news again this week.

Top-5:

OECD publishes guidelines on crypto tax reporting and proposes an automatic exchange of tax information between authorities. The guidelines are an attempt to mitigate the concern that crypto assets were falling through the cracks of existing tax reporting standards.

US SEC reportedly probing Yuga Labs‘ NFT issuance and ApeCoin token.

EU’s Market in Crypto Assets Regulation clears next hurdle. Only plenary vote in EU Parliament left.

Singapore’s MAS granted an in-principle approval under the Payment Services Act to crypto exchange Coinbase and Blockchain.com. This brings the number of crypto companies approved to operate in Singapore to 18 – roughly 10% of the number of applicants.

Portugal stood out for its tax-free treatment of crypto gains. The new budget proposal wants to reverse course and impose a 28% tax on gains from crypto assets held for less than 1 year.

And also…

DAOs - The CFTC could validly serve a summons to OokiDAO through an online chat box, a US court held. The DeFi Education Fund and others had argued that DAOs are not 'associations' and therefore are not a ‘person”’capable of being a defendant in an enforcement action brought under the Commodity Exchange Act.

The latest on the EU’s Transfer of Funds Regulation (TFR):

US – Crypto exchange Bittrex settles charges it unwittingly violated US sanctions and money laundering law with $30 million payment and promise to boost compliance.

Crypto tax was the topic of an EU Parliament resolution, which suggests DLT can help automate tax enforcement but that authorities, including the European Commission, first need to define crypto taxable events.

“There may be different options to define a relevant taxable event such as the creation of coins via mining, the exchange of crypto-assets into fiat currency or other crypto-assets, a hard fork or the staking of crypto-assets; notes that a coherent definition of a taxable event needs to be found in order to ensure a proper level of taxation, while avoiding instances of double taxation; automate tax collection”.

Embedded supervision in DeFi? The European Commission wants to know how it can use DeFi tools to supervise… DeFi. A call for tender worth €250,000 seeks a pilot project to use on-chain data for real-time “automated supervisory data gathering”.

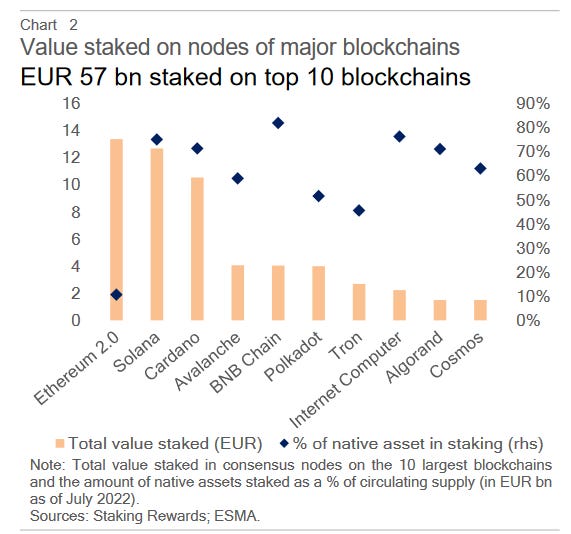

Links between traditional financial markets and crypto are still limited, according to the EU’s financial market regulator ESMA. It calls for a “swift” implementation of the EU’s draft MiCA rules. Its latest report on crypto looks into DeFi exploits and governance issues, institutional adoption, staking risks and more.

Canada – Ontario Securities Commission’s Statement of Allegations on the “fraudulent offering of crypto security tokens that serves as a cautionary tale to investors interested in the crypto asset sector” in yet another crypto scam.

The EU extended its sanctions on transactions with (non-EU based) Russians, now covering all crypto transactions regardless of transaction size. Dapper Labs reacted by suspending accounts with Russian connections, saying it’s compelled to do so as its payment processing partner is required to comply with the EU sanctions.

The Financial Stability Board is seeking public feedback on its proposed framework for the international regulation of crypto asset activities. The FSB published one report on crypto asset regulation and supervision in general and a second one on global stablecoins. In the former, it expressed concern about crypto companies combining multiple services in a single provider: “Some trading platforms, besides their primary functions as exchanges and intermediaries, also engage in custody, brokerage, lending, deposit gathering, market-making, settlement and clearing, issuance distribution and promotion. Some trading platforms also conduct proprietary trading or allow proprietary trading on the platform by affiliated entities.” There are limited references to DeFi, although the FSB expects effective governance to be in place “irrespective of the structures of activities”. The FBS plans to finalize its crypto asset guidance by mid-2023.

Kazakhstan granted a license to crypto exchange Binance.

India proposes a phased, small-scale pilot of a digital rupee. It is considering both a retail and a wholesale CBDC.

Terra’s former head of general affairs was the first employee to be arrested over Terra’s collapse, but was released after a judge found his detention wasn’t necessary.

NFT projects are reviewing their royalty policies:

The Law of Code’s podcast discussed Can't Be Evil NFT Licenses:

And Around the Blockchain’s most recent newsletter: Keeping up with the Kardashians; Celsius blunders continue; FSOC's Book Report; MiCA is here; DeFi Education Fund stands up to CFTC; and more.

Thanks for reading!