EU's MiCA passes vote. UK proposes Defi staking and lending tax rules. US SEC definition of exchange faces DeFi criticism. Hong Kong continues crypto push. Bahamas revamps crypto law.

Hello everyone,

The EU’s Parliament voted in favour of the long-awaited Market in Crypto-Assets (MiCA) Regulation, the EU’s comprehensive crypto rulebook. The crypto industry reacted cautiously positive. An overwhelming majority of MEPs backed the new rules, which will be refined and supervised by various EU authorities. For a detailed breakdown, see here. The Parliament also voted on the Transfer of Funds Regulation, a separate set of rules that imposes licensing for crypto exchanges and wallet providers.

The adoption of the EU’s MiCA is adding pressure on lawmakers and regulators elsewhere to clarify the crypto rulebook, particularly in the UK and the US.

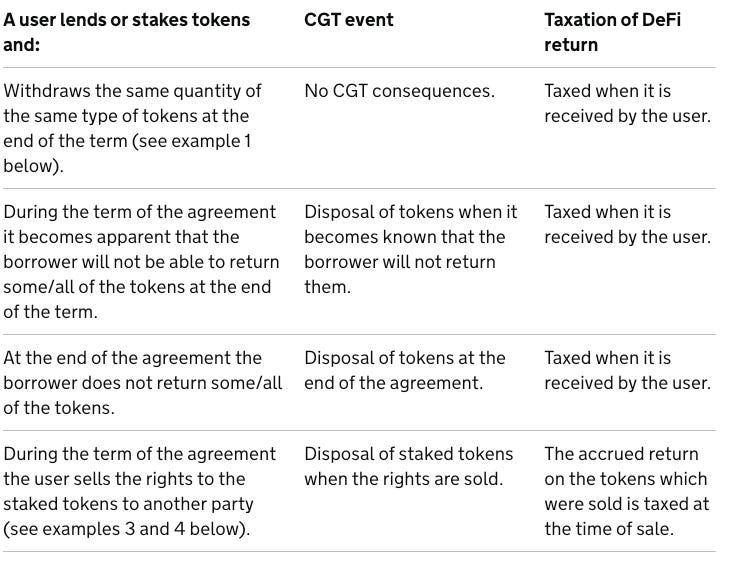

• In the UK, a Treasury consultation on financial crypto activities, including a DeFi chapter, closes very soon. An FCA official invited the crypto industry to “work together”. The UK Treasury is now also consulting on tax proposals for DeFi lending and staking. The consultation closes on 22 June. Key proposals:

• In the US, the SEC’s Gary Gansler came under attack from crypto advocates again for refusing to say during a congressional hearing whether ETH is a security.

The SEC also proposed changes to the definition of “exchange” that may cover a wide range of crypto trading platforms, including DeFi exchanges. The proposal is “effectively a position to simply destroy DeFi”, according to one academic. The SEC re-opened the comment period, now running until 13 June.

• Coinbase turned to a US federal court in the hope of forcing the SEC to bring greater clarity on crypto regulation. It also published its response to the SEC’s Wells Notice.

• Hong Kong is boosting its efforts to become a crypto hub. The securities regulator plans to release crypto licensing guidelines in May, after a consultation drew over 150 responses. Separately, an official of the Hong Kong Monetary Authority warned banks not to reject crypto companies’s applications for bank accounts too easily: crypto entities should be able to obtain bank accounts in Hong Kong “through a reasonable process”, he said. And a court confirmed that crypto assets are property, further adding legal certainty to the crypto sector.

• South Korea took another step towards its comprehensive crypto bill for financial crypto activities, initiated shortly after last year’s Terra meltdown. The bill covers crypto custody and trading, among other things. It imposes reserve and insurance requirements and separation of client assets. The bill was introduced shortly after last year’s Terra meltdown, for which a Terra Labs co-founder and several others were indicted this week. Terra’s other co-founder, Do Kwon, was indicted in Montenegro last week after entering the country with falsified ID documents.

• Binance is re-entering Japan through the acquisition of a regulated domestic crypto entity. Binance had previously abandoned its Japanese activities after failing to secure its own licence and warnings from the regulator that it was operating unlawfully.

• The Securities Commission of the Bahamas published a revised version of the crypto-focused DARE Act, which is open for consultation until 31 May. The revamp of the legal framework comes in the wake of the collapse of FTX, which was headquartered in the Bahamas.

• The Abu Dhabi Global Market (ADGM) authority published proposed rules for decentralized blockchain projects, covering DAOs and other decentralized applications. The consultation closes on 12 May.

• The Zimbabwean Central Bank is contemplating a gold-backed digital token.

Thanks for reading!