EU MiCA deal, bank crypto cap Basel proposal, how to tax DeFi lending & staking, crypto VC tech bro problem

CryptoLaw Newsletter #57

Hello everyone,

TLDR:

EU negotiators reach deal on Markets in Crypto Assets (MiCA) Regulation

Cap on bank crypto holdings: Basel prudential regime update

Singapore considers tighter crypto retail rules as 3AC forced to file for bankruptcy

Who’s hurt most by crypto price crash?

How to tax DeFi lending and staking?

Crypto VC’s tech bro problem

China and BIS digital yuan liquidity arrangement

Top-5 this week:

EU negotiators strike deal on Markets in Crypto Assets Regulation. Negotiators from the European Parliament and the Council reached a political agreement on the MiCA Regulation, the EU’s new crypto rulebook. We don’t have the final text yet: the agreement first needs to be adopted formally by both the EU Parliament and the Council before it is officially published and comes into force – likely at the end of 2022 or early 2023. Here’s what we do know: (most) NFTs and (genuine) DeFi are out, but some environmental disclosure is in. MiCA covers cryptoassets that are not financial instruments, but the dividing line isn’t clear yet (ESMA, the EU’s securities regulator, is tasked with offering guidance on that dividing line). The rules apply both to crypto issuers, such as stablecoin issuers, and service providers, although NFTs (such as in-game items or collectibles) are generally excluded and the text reporteldy doesn’t cover DeFi either. The new rules impose transparency and disclosure obligations, for example to publish and update whitepapers. MiCA also imposes market abuse rules, similar to financial market regulation. Signifcant crypto-asset service providers will have to disclose their energy consumption – a compromise that replaced the unsuccessful call for a ban on proof-of-work blockchains (the ‘bitcoin ban’). ESMA will become the new crypto sheriff, according to MEP Urtasun, and will maintain a register of third country crypto service providers that operate in the Union without authorisation. The political agreement on MiCA came just days after a compromise was reached on a revised Transfer in Funds Regulation, laying down KYC rules for crypto transactions. MiCA imposes complementary anti-money laundering safeguards. For all the criticism that MiCA has faced, and all the open questions that remain, there is little doubt that this comprehensive rulebook will set the benchmark for lawmakers around the world.

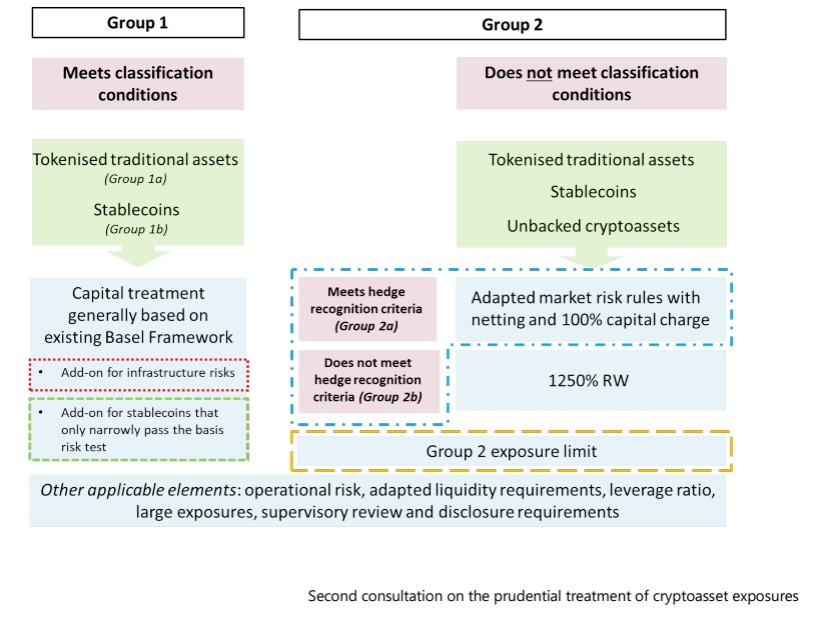

Revised proposal for banks‘ crypto exposure. The Basel Committee published a second consultation document on its proposed prudential regime for banks‘ crypto holdings. The key ideas from the first proposal remain, but there are a few clarifications. The proposed regime distinguishes between two groups of crypto assets that banks can hold. Group 1 includes tokenised assets and stablecoins that meet a number of conditions, including sufficient reserves even in extreme stress conditions and the maintenance of a stable peg. Banks holding these Group 1 crypto assets will be subject to capital rules generally equivalent to existing Basel prudential rules. Group 2 covers cryptoassets that are deemed less safe, such as unbacked cryptoassets and stablecoins that do not meet the above redemption and peg stability tests. The Basel Committee wants banks to cap their exposure to such assets to maximum 1% of Tier 1 capital.

Singapore considers tighter crypto retail rules as 3AC forced to file for bankruptcy. Crypto hedge fund Three Arrows Capital filed for bankruptcy after a British Virgin Islands court order. The whereabouts of its co-founders are unknown. The embattled fund was previously reprimanded by the Monetary Authority of Singapore (MAS) for providing false information. MAS made clear it plans to strike “unrelentingly hard” against bad crypto behaviour. Now MAS is considering tighter crypto rules to protect the retail public. “These may include placing limits on retail participation, and rules on the use of leverage when transacting in cryptocurrencies.”

Who’s most hurt by the crypto crash? Spectacular failures of large crypto companies may be dominating the headlines, but what about retail holders? A quarter of black American investors owned cryptocurrencies at the start of the year, compared with only 15 per cent of white investors, according to survey. “As far as I can tell, the black community sees crypto as a way to even the playing field and get in the game before the gatekeepers prevent others from participating,” said one crypto-holder to the FT. As crypto prices nosedived, however, this has led to steep losses in households that may be least able to absorp them.

How to tax DeFi lending and staking? The UK Treasury is asking the public in a consultation that closes 31 August. The government wants to know “whether administrative burdens and costs could be reduced for taxpayers engaging in this activity, and whether the tax treatment can be better aligned with the underlying economics of the transactions involved.”

And also…

Crypto mayhem continues: Voyager digital halts withdrawals and Singapore-based crypto lending platform Vauld halts operations. Nexo denies rumour of weak financials. Circle‘s CEO counters rumours about reserves, saying the USDC-issuer is in the “strongest position ever”.

China’s central bank and the BIS set up an digital yuan liquidity arrangement.

The European Central Bank will this week warn member states that they urgently need to harmonize their diverging crypto rules before the EU’s flagship crypto rulebook comes into force.

Liquidity protocol CremaFinance, built on Solana, lost over US$8 million after flash loan exploit.

New York regulator denies bitcoin miner application, citing climate goals.

Grayscale faces difficulties winning its ETF lawsuit against the US SEC.

Crypto exchange Coinbase provides geo-tracking data to US immigration body ICE

The US Pentagon released a report funded by DARPA claiming concerning vulnerabilities on the Bitcoin and Ethereum blockchains, but commentators are not impressed: nothing new, they say, and unlikely to pose a significant threat in practice.

The crypto thief (North Korean state actor?) behind the Horizon Bridge attack put the stolen funds through Tornado Cash‘s mixer. However the hacker has been overcharged by more than $650,000 in fees to do so. An unexpected twist or all part of the initial plan?

Alibaba, Baidu, Tencent and other Chinese tech giants will impose ID checks for NFT purchases. In a statement, the signatories to the initiative also pledge “to avoid setting up secondary marketplaces for NFT trading and ‘firmly resist speculation’”.

The US DoJ filed charges against a rug-pull by Baller Ape Club.

The balance sheets of large bitcoin-holding companies such as Tesla, Block and Microstrategy are down more than US$2 billion collectively in the aftermath of the crypto sell-off.

The first “crypto hater” conference in London wants to let sceptics share their concerns with government officials.

A US congressional hearing discussed the tech-bro problem in crypto: “Venture capitalists tend to invest in companies with predominantly white male leadership, while women and people of color ‘remain in the waiting room’,” according to Rep. Stephen Lynch quoted in Cointelegraph.

Thanks for reading! You’ll have to miss the weekly update for one week (next week), but we’ll be back soon!

Want to read more crypto & law insights? Check out Around the Blockchain by Christopher Foreman and Kyler Wandler.