CryptoLaw Newsletter #50

Terra meltdown raises regulatory pressure; what about your coins if Coinbase goes bankrupt? Crypto accounting review; Nvidia settles SEC charges; Nigeria stifling innovation, says UN

Hello everyone,

TLDR:

Terra meltdown leads to more stablecoin regulatory pressure.

What happens with your coins if Coinbase goes bankrupt? You may be last in line, the exchange warns.

SEC Chair doesn’t like crypto exchanges trading against their own customers.

How to account for bitcoin in corporate books? The FASB is reportedly reviewing crypto accounting rules.

Crypto in corporate disclosure: Nvidia settles charges by US SEC for misleading reporting.

Nigeria doubles down on CBDC while UN warns crypto restrictions stifle fintech.

Top-5 this week:

The Terra network breakdown continues to dominate crypto news. Algorithmic stablecoin TerraUSD lost its peg. Terra (LUNA) lost more than 90% of its all-time-high value. Bitcoin reserve holdings muddied the picture further, as bitcoin was sold in an attempt to stop further damage to the Terra stablecoin peg. “The most destructive and damaging week in the history of the crypto industry,” tweeted NLW.

He and many others warned about the regulatory implications that this meltdown will likely have. And indeed: it didn’t take long before US Treasury Chair Janet Yellen used it as an example in a Senate hearing for why stablecoin regulation is urgently needed.

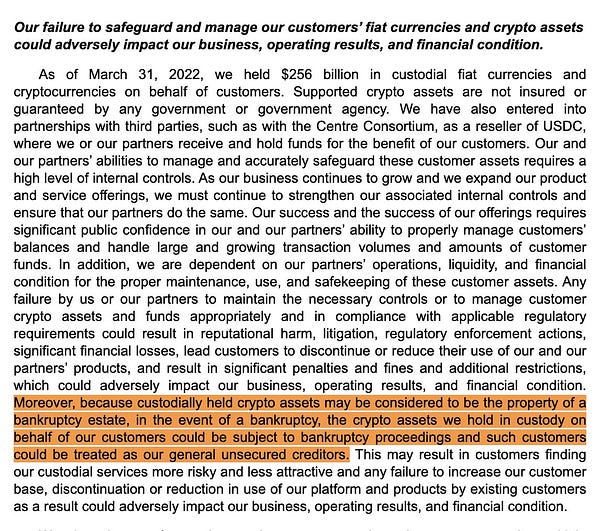

If Coinbase goes bankrupt, what happens with your tokens as a customer? The exchange’s most recent disclosure drew attention for reporting its first net loss, but also because of this warning that you may be last in line:

New disclosure in today's $COIN (Coinbase) 10-Q: 👀 "In the event of a bankruptcy.....customers could be treated as our general unsecured creditors." 🚩🚩🚩 🚨Get your #Bitcoin off exchanges.🚨

New disclosure in today's $COIN (Coinbase) 10-Q: 👀 "In the event of a bankruptcy.....customers could be treated as our general unsecured creditors." 🚩🚩🚩 🚨Get your #Bitcoin off exchanges.🚨

Coinbase CEO Brian Armstrong defended the update on Twitter, adding retail users have to option to self-custody their digital assets through the Coinbase Wallet.

SEC Chair Gensler doesn’t like what he sees: crypto-exchanges trading against their own customers. Exchanges are “trading against their customers often because they’re market-marking against their customers,” he said. He’s also concerned that the top stablecoins are linked to exchanges.

How to account for bitcoin on corporate books? When the US US Securities & Exchange Commission rejected MicroStrategy’s bitcoin accounting, the company’s share price plummeted. Now its CEO is rejoicing: the Financial Accounting Standard Board (FASB) reportedly is reviewing accounting rules for digital assets held on corporate balance sheets. Clear accounting rules may draw more institutions into the crypto space.

Nvidia settled charges with the US SEC “for inadequate disclosures concerning the impact of cryptomining on the company’s gaming business“. The company misled investors by not disclosing that much of its increase in gaming sales were driven by the “volatile business” of cryptomining.

And also…

The Financial Stability Board is “well placed to take a leading role in the design of a coherent global regulatory framework for crypto assets”, according to its Chair Klaas Knot.

Germany’s Finance Ministry published official guidance on crypto taxation. The guidance covers income tax rules on gains from crypto mining, staking, lending, airdrops and more. you can sell your crypto-assets tax-free after holding them for one year (rather than 10 years, as initially proposed), even if you staked/lent them.

Coinbase CEO Brian Armstrong blamed to strong “informal pressure” from the Reserve Bank of India as a reason for pulling out of a widely held payment system in the country. The central bank’s position may be in violation of a crypto ruling by the country’s Supreme Court, he hinted.

Nigeria is upgrading its CBDC, although the country’s crypto restrictions are stifling fintech innovation, according to the United Nations.

El Salvador is buying the bitcoin dip, adding US$15.5 million worth of BTC to the country’s reserves.

The IMF hinted at the importance of “robust supervisory and regulatory framework” for digital assets in its Bahamas review.

Argentina’s central bank blocks banks‘ crypto offerings.

Crypto assets briefly featured in the Queen’s Speech setting out UK parliamentary priorities:

Bank of Israel says public feedback on its CBDC proposal was largely positive, although privacy concerns run deep.

A CBDC survey by the Bank for International Settlements (BIS) showed 90% of central banks are exploring CBDCs; more than two thirds are likely to issue a retail CBDC in the short or medium term; work on CBDCs is increasingly driven by reasons related to crossborder payments efficiency and was accelerated by covid-19 and the emergence of stablecoins and other cryptocurrencies.

Law firm K&L Gates discusses jurisdictional tussles between the SEC and CFTC over digital assets, analysing enforcement actions such as those against Ripple, BlockFi, Kraken and Bitfinex.

Law firm Sullivan & Cromwell discusses California Governor Newsom’s Executive Order on bockchain and crypto. It sets out key principles for California’s crypto approach, such as preparing a web3 regulatory approach and exploring public-serving use cases. The Order wants stakeholder input, including from “communities that have not historically benefitted from technology-driven economic growth”.

The UK FCA is holding its 2-day crypto policy sprint with invited stakeholders. The sprint brings together experts from academia and industry, among others.

“Decentralized finance can actually spread out risk across more people, which tends to be good for resilience,“ said US SEC Commissioner Peirce. “So I worry that people get drawn in just by the desire to see numbers go up without anything else. But again, I think people are very capable of making their own decisions about how to spend the money that they work very hard to earn. And so I don't need to stand in the way of them doing that.” She talked about why she’s not a fan of the ‘CryptoMum’ moniker.

Five US states issue emergency shutdown orders for metaverse casino with alleged Russian ties.

FTX US will make Chicago its US headquarters and applied for a Trust Charter in New York State.

Binance reportedly halted crypto derivatives services in Spain.

Thanks for reading!

Check out Jacob Robinson’s Law of Code for podcasts of CryptoLaw’s newsletter and much more (web3, NFTs, DAOs & more).